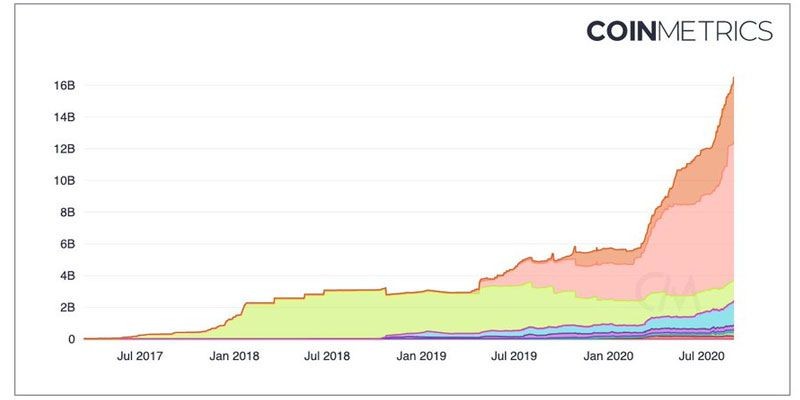

Coinmetrics: stablecoin capitalization grows by $ 100 million a day

According to the analytical portal Coinmetrics, the boom of decentralized financing projects also affects stablecoins - the capitalization of the stable cryptocurrency market is growing by about $ 100 million per day.

"Everyone got so excited about DeFi no one pointed out that stablecoins have been adding $100m/day since mid-July. DeFi yields/interest rates are clearly a vacuum sucking in a lot of stablecoins," Coinmetrics co-founder Nic Carter wrote on Twitter.Tether remains the largest stablecoin. If on July 15 its capitalization was $ 9.2 billion, then at the moment it has reached $ 13.7 billion, having increased by almost 50%. During the same period, USDT trading volume increased by 150% from $ 21.9 billion to $ 54 billion per day.

It is interesting that this fact did not go unnoticed by the officials. For example, Bank of England Governor Andrew Bailey said stablecoins could "offer some benefits" to UK investors. For example, simplify payments. At the same time, he stressed that such coins must comply with the standards applicable to other means of payment.

"A global stablecoin is a cross-border phenomenon. It can be operated in one jurisdiction, denominated in another's currency, and used by consumers in a third. The regulatory response must match this,"

Andrew Bailey said

Tether recently announced plans to integrate Ethereum's second-tier ZK-Rollups scaling solution to reduce blockchain load and transaction fees. Currently, the average transaction fee on the Ethereum network reaches $ 15.