Currency.com: Bitcoin could rise to $ 170,000 after halving the miners' reward

The most anticipated event of the cryptocurrency industry in 2020 is the halving of the Bitcoin miners award (halving). Many associate with him a new growth cycle of the cryptocurrency market.

In the traditional economic system, the Central Bank regulates the exchange rate of the national currency, which, if necessary, can saturate the economy with money or withdraw it from circulation. There are various tools for this: currency intervention, a quantitative easing program, raising or lowering interest rates on loans and deposits for commercial banks and other methods. They allow the Central Bank to contain or increase inflation and, in general, influence the economic situation in the country.

In the case of Bitcoin, which does not have a Central Bank, the inflation rate is regulated according to the general consensus of the network by a cryptographic algorithm that determines the number of coins issued over a period of time. Every 10 minutes, miners get a new block, which records network transactions and which contains information about previous blocks. For generating a new block, the miner receives a reward from the network, embedded in the algorithm, which in its essence is the emission of Bitcoin. Every 210,000 blocks, the production of which takes about 4 years, the amount of remuneration or emission is reduced by 2 times. This halving is called halving.

Before halving in 2012, miners received 50 BTC for the mined block, after which the reward decreased to 25 BTC. After halving in 2016, the amount of remuneration decreased to 12.5 BTC. In May 2020, after the third halving, the issue for the mined block will be 6.25 BTC. In 2138, two years before the last Bitcoin mined, the last halving in history will take place, after which the reward for miners will be 0.000000005820766091 BTC. It will be a very modest reward, even if Bitcoin costs $ 1 billion, but the last coins mined can cost a fortune. The main source of income for miners by that time will be the commission for transactions.

Thus, the halving task is the gradual reduction and distribution of BTC emissions over 130 years. Halving restrains hyperinflation, makes Bitcoin scarcer, which positively affects its value in the future. Accordingly, the cryptocurrency community is not unreasonably waiting for a new halving, behind which a new wave of Bitcoin growth is quite likely.

For most participants in the cryptocurrency community, all of the above is completely a mystery, however, there are 3 main questions that interest everyone:

- How will Bitcoin behave before halving?

- Will there be growth immediately after halving?

- What will happen to the price of Bitcoin in the next 1.5 - 2 years?

Analyst of the regulated cryptocurrency exchange Currency.com Mikhail Karhalev studied the behavior of Bitcoin before and after halving over the previous 10 years of the coin's existence and discovered certain patterns. Based on them, the analyst formed a growth model for Bitcoin and shares his assumptions with the community.

Economy cycles

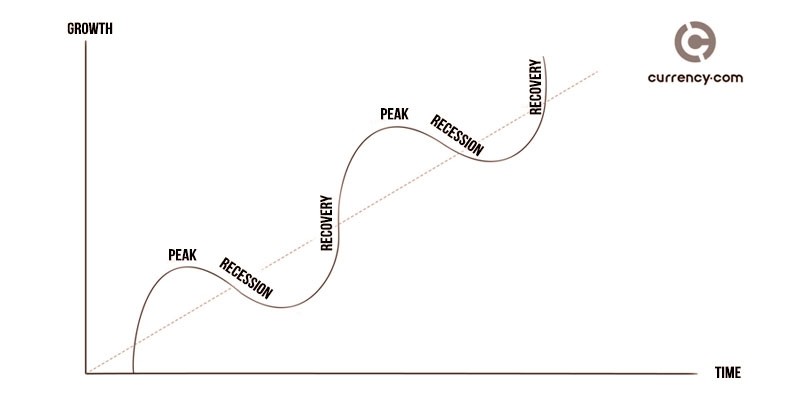

One of the tenets of Charles Dow, the creator of technical analysis, states that history always repeats itself. This applies not only to stock markets, but also to any economic model or system. Growth always follows a fall, a bottom falls, a recovery follows a bottom, and a peak recovers. There are four most famous cyclic models:

- Kitchin cycles - 2-4 years;

- Cycles of Juglar - 7-11 years old;

- Kuznets cycles - 11-25 years;

- Kondratiev's cycles are 45-60 years old.

These loops look like this:

Here comes the first interesting observation. Kitchin's cycles are short-term economic cycles with a characteristic period of 2-4 years, which the economist himself associated with short-term cycles of fluctuations in world gold reserves. By creating Bitcoin, Satoshi Nakomoto developed a self-sustaining system that would look like gold mining and reduce coin emissions every 4 years. Accordingly, the entire economic cycle "Peak - Recession - Bottom - Recovery" should take place over 4 years, which is very similar to Kitchin's cycles.

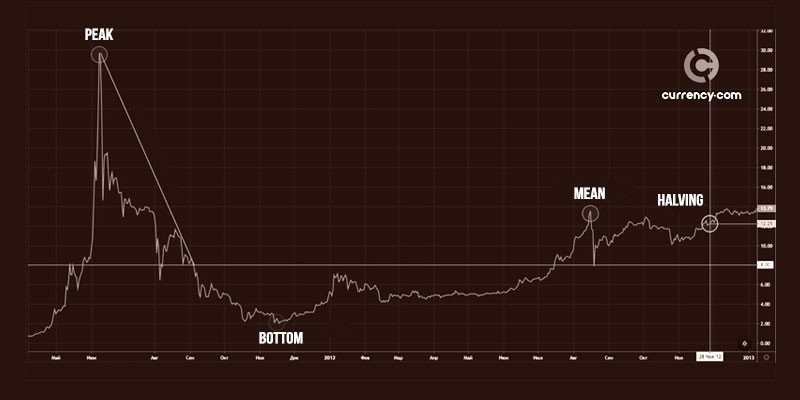

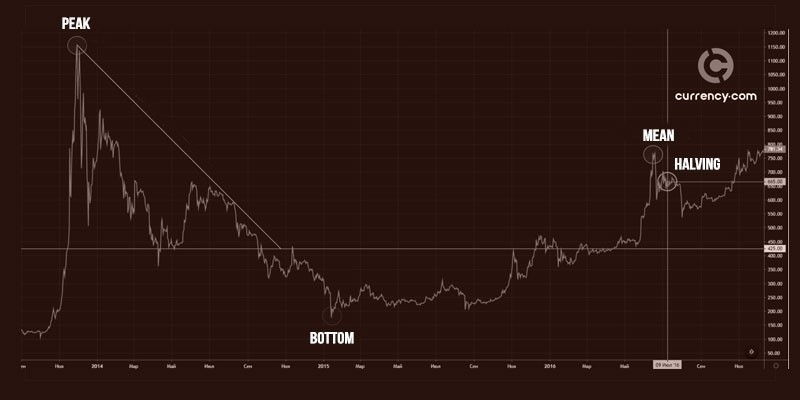

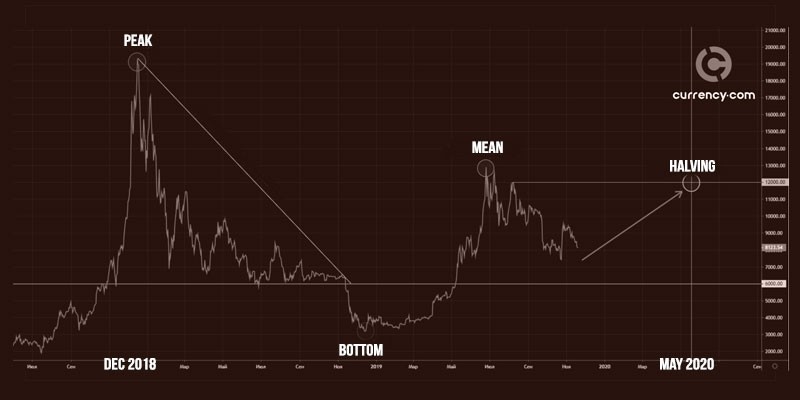

The scenario was always the same: Peak - Descending Triangle (Recession) - Bottom - Restore to average - Halving.

First, the price peaks after a powerful bull rally. Having reached the top, Bitcoin begins to fall according to the "Descending Triangle" technical analysis model. Before breaking through the support level, the price bounces several times from it, after which breakdown and movement to the bottom occur. Further, there is a gradual process of price recovery to the average from the previous peak. The remaining period of time before halving, the price moves in different directions, but returns to the average value from the previous peak by halving. After halving, Bitcoin gradually moves to growth and soon conquers a new peak.

2011-2013

Bitcoin reached its first peak at $ 32 in June 2011, followed immediately by a collapse. The fall occurred within the framework of the technical analysis model "Descending Triangle". Price highs were constantly decreasing, and the support line was the level of $ 8. After the breakdown of the support level, the price rushed to the bottom, which became the mark of $ 2. This was followed by the recovery process to the average value from the previous peak - this is $ 15. Before halving, the price moved in different directions, but on the day of halving, November 28, 2012, it was $ 12.25, which is close to the average value from the previous peak. 13 months after halving the award, Bitcoin reached a new peak.

2013-2016

A similar model was observed during the period from December 2013 to July 9, 2016: "Peak - Descending Triangle - Bottom - Recovery to the average value from the previous peak - Halving." The peak fell at the level of $ 1 177, the bottom - $ 163, the average value - $ 784, and the price came to halving at around $ 665. 17 months after halving, the price again rushed to a new peak, which remains today at a historic maximum.

2017-2020

In December 2017, the peak hit $ 19,794, followed by a recession, the bottom at $ 3,148 and recovery. Today we already know the recovery price or the average value from the previous peak - $ 13,830. If you follow the logic of the resulting model, the price will return to about $ 12,000 by the date of halving. Why?

Bitcoin price before halving 2020

The percentage difference between the price of restoration and the price on the day of halving is usually 9-10%. In 2012, the recovery price was $ 15 or 46.87% from the previous peak at $ 32, the price on the day of halving was $ 12 or 37.5% from the previous peak at $ 32. The difference between the two values is 9.37%.

In 2016, the recovery price was $ 784, or 66.6% of the previous peak at $ 1,177, the price on the halving day was $ 665, or 56.49%. The difference between the two values is 10.11%.

Following this logic, $ 13,830 is 69.86% of the peak at $ 19,794; accordingly, to halving, the price will be approximately 59.8% - 60.8% of the peak, or $ 11,836 - $ 12,034, which corresponds to the key resistance level of $ 12,000, which opens the way for Bitcoin to new growth.

Bitcoin Growth Model

By visualizing all the observations in a whole picture, the following Bitcoin growth model is emerging, with which you can predict a new peak, which will be conquered after halving 2020.

The first serious increase in Bitcoin occurred in 2010, when the price reached 50 cents per coin. The second peak was at $ 32, which is 64 times more than the previous peak at 50 cents. The third peak was at $ 1,177, which is 36.8 times more than the previous peak at $ 32. The fourth peak is $ 19,794 more 16.8 times higher than the peak of $ 1,177.

Note that the growth force actually halves each time:

The ratio of the growth force between peak 1-2 and peak 2-3 is 1.74 (64 / 36.8 = 1.74);

The ratio of the growth force between peak 2-3 and peak 3-4 is 2.19 (36.8 / 16.8 = 2.19).

To find out the future growth force and the new peak, it is necessary to find out the average value of the relationship between the previous growth forces:

(1.74 + 2.19) / 2 = 1.965.

Accordingly, if the last growth force 16.8 decreases 1.965 times, then the next growth wave will be x8.55 compared to the previous one.

19,794 * 8.55 = $ 169,238 - this is the predicted value for the next peak of Bitcoin.

According to statistics, after halving, growth begins almost immediately, but moves gradually, updating the historical maximum after 5-7 months. After a short correction, which lasts several weeks, growth continues, moving to a long bull market during the year, after which a new peak is reached. Accordingly, an update of the price maximum can be expected about six months after halving, that is, by the end of 2020, and a new peak - after 18 months, that is, by the end of 2021.

Summary

Based on the above observations and calculations, we can draw the following conclusions:

- According to statistics, on the day of halving, the price is at about average values from the previous peak, respectively, it will be expected to be expected at the level of $ 11 836 - $ 12 034 in May 2020.

- Growth after halving begins almost immediately, but it is progressing gradually, updating the historical maximum only after 5-7 months.

- Presumably, if the observations and calculations are correct, then after 18-20 months the price of Bitcoin may be $ 169,238.

We draw your attention to the fact that the presented model was created on the basis of personal observations of Currency.com analyst Mikhail Karhalev, in no case is the ultimate truth and, all the more, a guide to action. Remember that cryptocurrencies are high-risk assets whose price is unpredictable in the future.

The author of the model has in his portfolio not only Bitcoin, but also other cryptocurrencies, including Ethereum, Litecoin, Ripple, Waves and Tron.